SWIFT BIC Codes Key to Avoiding International Payment Delays

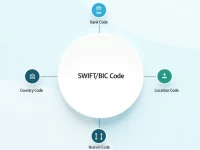

This article details the composition and significance of BANCOLOMBIA S.A.'s SWIFT/BIC code COLOCOBMBGA, as well as how to avoid delays in international remittances caused by incorrect codes. Clearly verifying the bank, branch, and country information is crucial for ensuring successful transfers.